Frontier Markets: A Compelling Way to Stay Invested in Troubled Times

After many years of near-zero interest rates, fixed income has once again captured investor attention as rates surged post-Covid and following the outbreak of the war in Ukraine. One interesting areas within the broad fixed income universe is USD-denominated bonds issued by sovereign states in Frontier Markets.

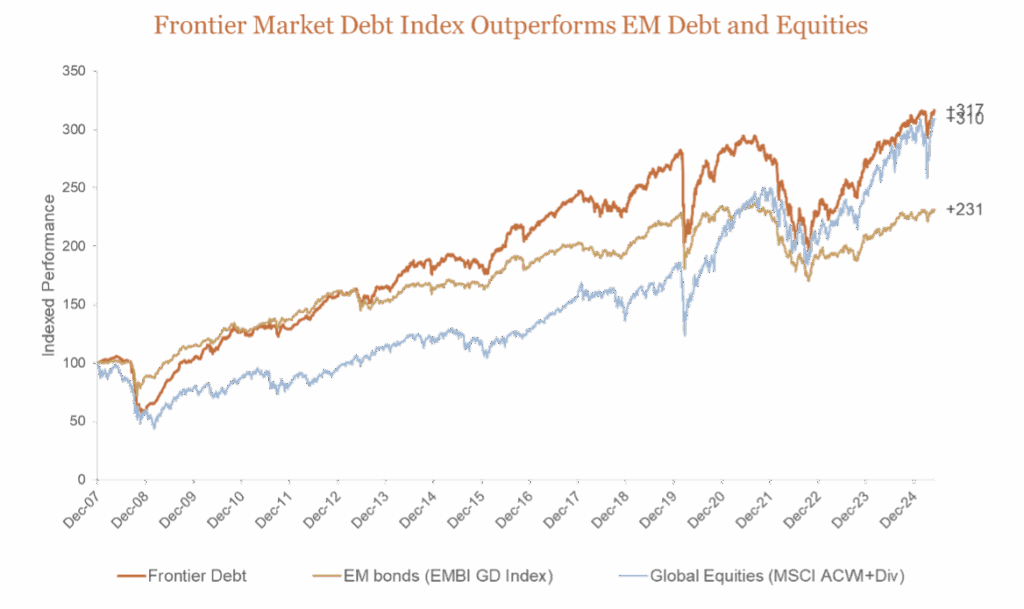

The Frontier fixed income market offers a compelling way to stay invested during uncertain times. With yields around 9% in USD, it presents a rare combination: equity-like returns with roughly half the volatility of global equities, daily liquidity, portfolio diversification, and upside potential if the global environment improves. Over the long term, Frontier Markets have even outperformed global equities—offering a superior risk-return profile (Sharpe ratio).

Source: JPMorgan, Bloomberg as of 3 June 2025

While ”Frontier Markets” may sound exotic to some, this asset class has been active and well-functioning for more than 20 years. It spans issuers from Latin America and Africa to Asia. What defines Frontier Markets is that they represent low-income developing countries with functioning financial markets. By definition, they are highly dependent on subsidized funding from sources such as the IMF, World Bank, and other development institutions.

Historically, much of this support came from Western countries, while China has significantly increased its lending over the past two decades, particularly in Africa.

For private investors, this subsidized funding is a critical backstop—as access is typically contingent on economic reform and, most importantly, remains available during periods of market stress. This contrasts sharply with corporate bonds, which lack institutional safety nets. The ability to rely on steady funding during crises allows private investors in Frontier sovereigns to ride out volatility, avoid forced selling, and wait for recovery—something not always possible in other asset classes.

Annons

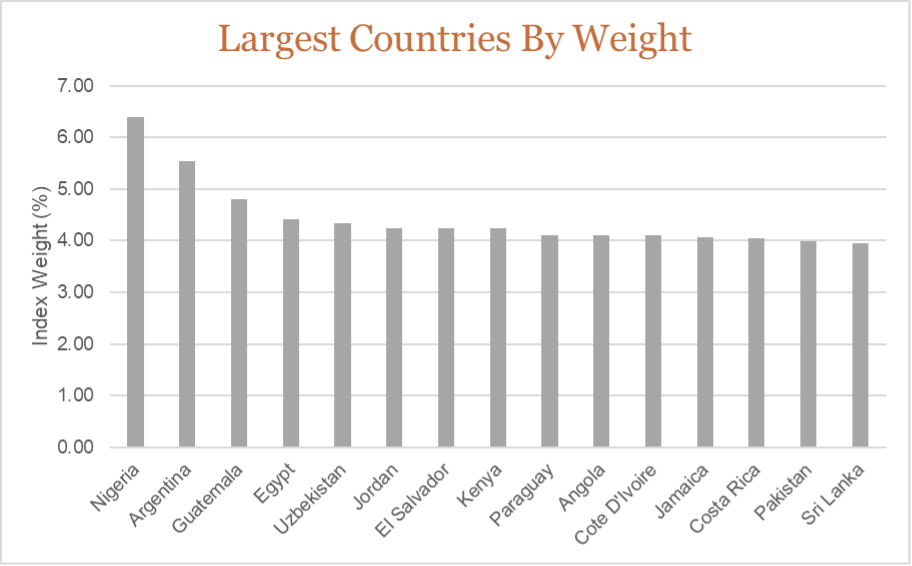

Frontier Markets, as classified by JP Morgan, are home to approximately 1.4 billion people—or nearly 20% of the global population. That’s roughly equivalent to the population of China or India but spread across 42 countries. This creates natural diversification across governments, currencies, and development stages.

By investing in Frontier Markets, you gain exposure to a globally diversified pool of countries—each driven by local factors. Put simply, what happens in Papua New Guinea has little to do with events in Côte d’Ivoire or Ecuador.

Source: JPMorgan

With a rapidly shifting geopolitical landscape, growing use of sanctions and tariffs, and large economies increasingly leveraging their size for strategic gain, Frontier Markets are becoming more important—both as sources of key natural resources and as future consumer markets. As a result, we are seeing increased engagement from developed economies, seeking to strengthen ties with these countries—creating further tailwinds for investors.

So Why Frontier Markets Now?

In a world awash with uncertainty, Frontier Market bonds offer high yields, broad diversification, and alignment with global development tailwinds. These are countries that have experience to navigate political and economic shocks but also were investors are accustomed to premiums from political noise.

With daily liquidity, structural support from development institutions, and exposure to some of the most resource-rich, fastest-growing populations globally, Frontier Markets represent a strategic opportunity for forward-looking investors—which will no doubt capture some of flows out of U.S. markets.

In short: higher yields, global diversification, and staying power through cycles. What more could you ask for in uncertain times?

// Lars Krabbe & Maciej Woznica, Senior Portfolio Managers, Coeli

Historisk avkastning är ingen garanti för framtida avkastning. En investering i värdepapper/fonder kan både öka och minska i värde och det är inte säkert att du får tillbaka det investerade kapitalet. Avkastningen kan också öka eller minska på grund av förändringar i valutakursen. Vi reserverar oss för eventuella fel i aktie- och fondinformationen som lämnas på denna sida. Åsikter och slutsatser som framkommer i bloggen är skribentens egna och skall inte ses som investeringsråd och/eller åsikter från Avanza.