The unprecedented convergence of disruptive technologies is creating a new era for investing

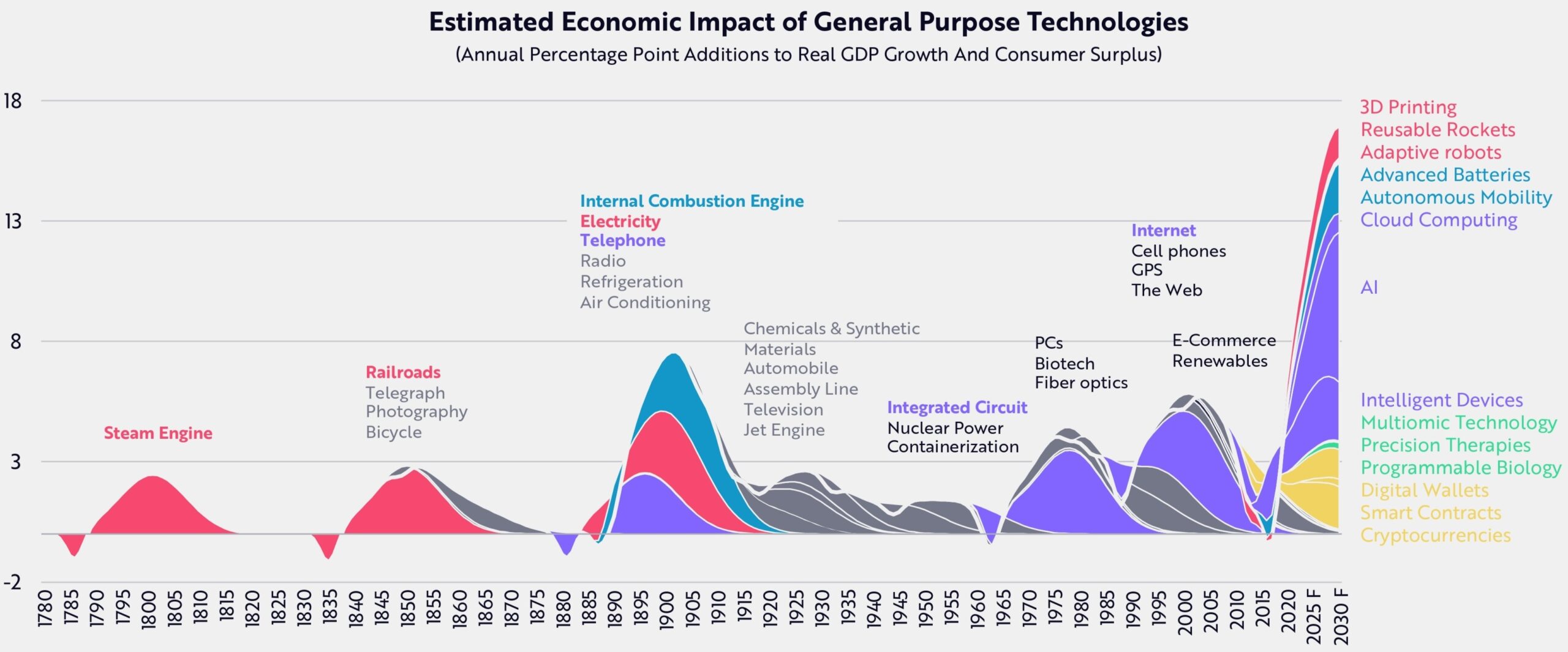

A remarkable convergence is occurring among five major innovation platforms: Artificial Intelligence (AI), Robotics, Energy Storage, Multiomic Sequencing, and Public Blockchains. Potentially surpassing the economic activity that occurred 120 years ago, when transformative technologies like the Telephone, Electricity, and the Internal Combustion Engine coalesced, the convergence between and among multiple innovation platforms is poised to reshape industries, societies, and the investment business in profound ways, as shown below.

Estimated Economic Impact of General Purpose Technologies

(Rough Annual Percentage Point Additions to the Economy, inclusive of consumer surplus) [1].

Each of the innovation platforms is significant, likely comparable to that of the Internet which, since the turn of the millennium, has generated over $10 trillion in global market capitalization. Now, as the five platforms advance and interact, the potential for economic impact and value creation is likely to be ‘super exponential’.

Annons

Technological Convergence

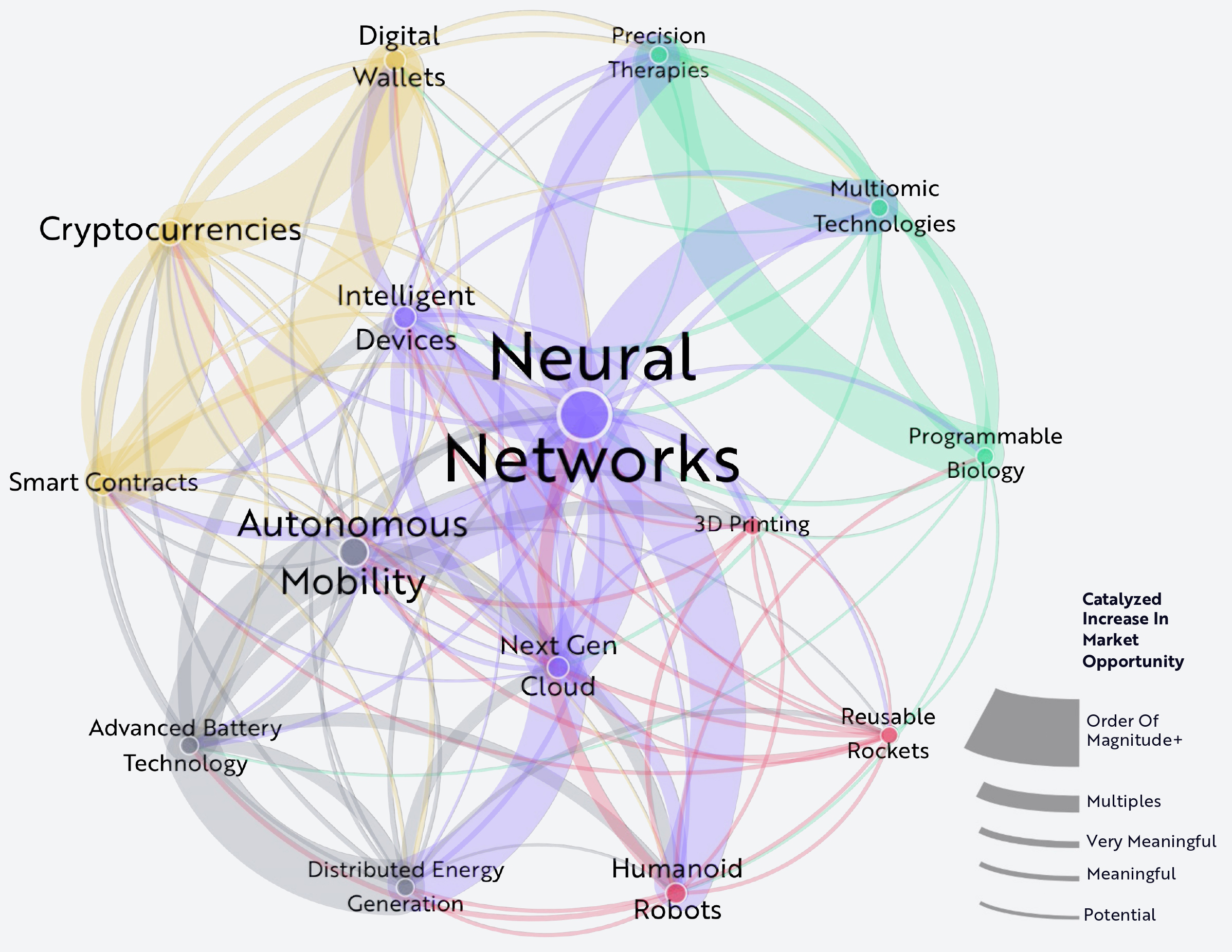

Technological convergence is the process in which advances in one field catalyse developments in others, leading to a cascade of progress. The synergies associated with AI are compelling, as it is catalysing and accelerating activities across a range of sectors. For example, AI is proving more critical to unlocking the value of Precision Therapies and Multiomic Technologies. Smart Contract ecosystems are serving as test beds in which autonomous AI agents can be renumerated for sharpening their capabilities. Next Gen Cloud energy demand is pulling forward timelines for Distributed Energy Generation.

Convergence Is Accelerating The Technology Revolution [2]

Convergence Is Accelerating The Technology Revolution [2]

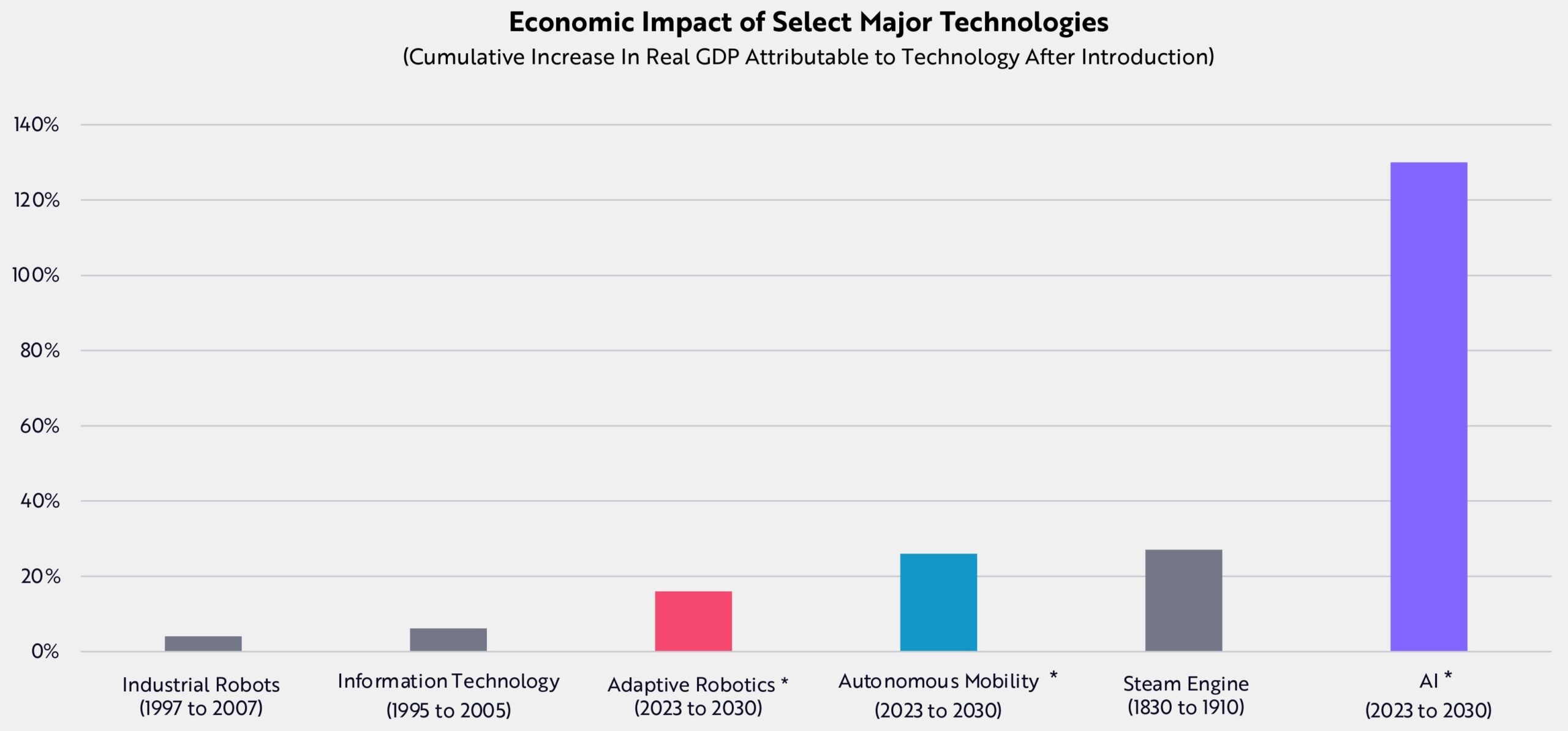

Indeed, the accelerated pace of AI seems poised to surpass the impact of the steam engine on real Gross Domestic Product (GDP) over the next five years, as shown in the chart below.

The Impact Of These Technologies On The Economy Should Prove Dramatic [3] Moreover, the collapse in projected timelines for milestones like artificial general intelligence (AGI) highlights the accelerating pace at which AI is achieving breakthroughs once thought to be decades away.

The Impact Of These Technologies On The Economy Should Prove Dramatic [3] Moreover, the collapse in projected timelines for milestones like artificial general intelligence (AGI) highlights the accelerating pace at which AI is achieving breakthroughs once thought to be decades away.

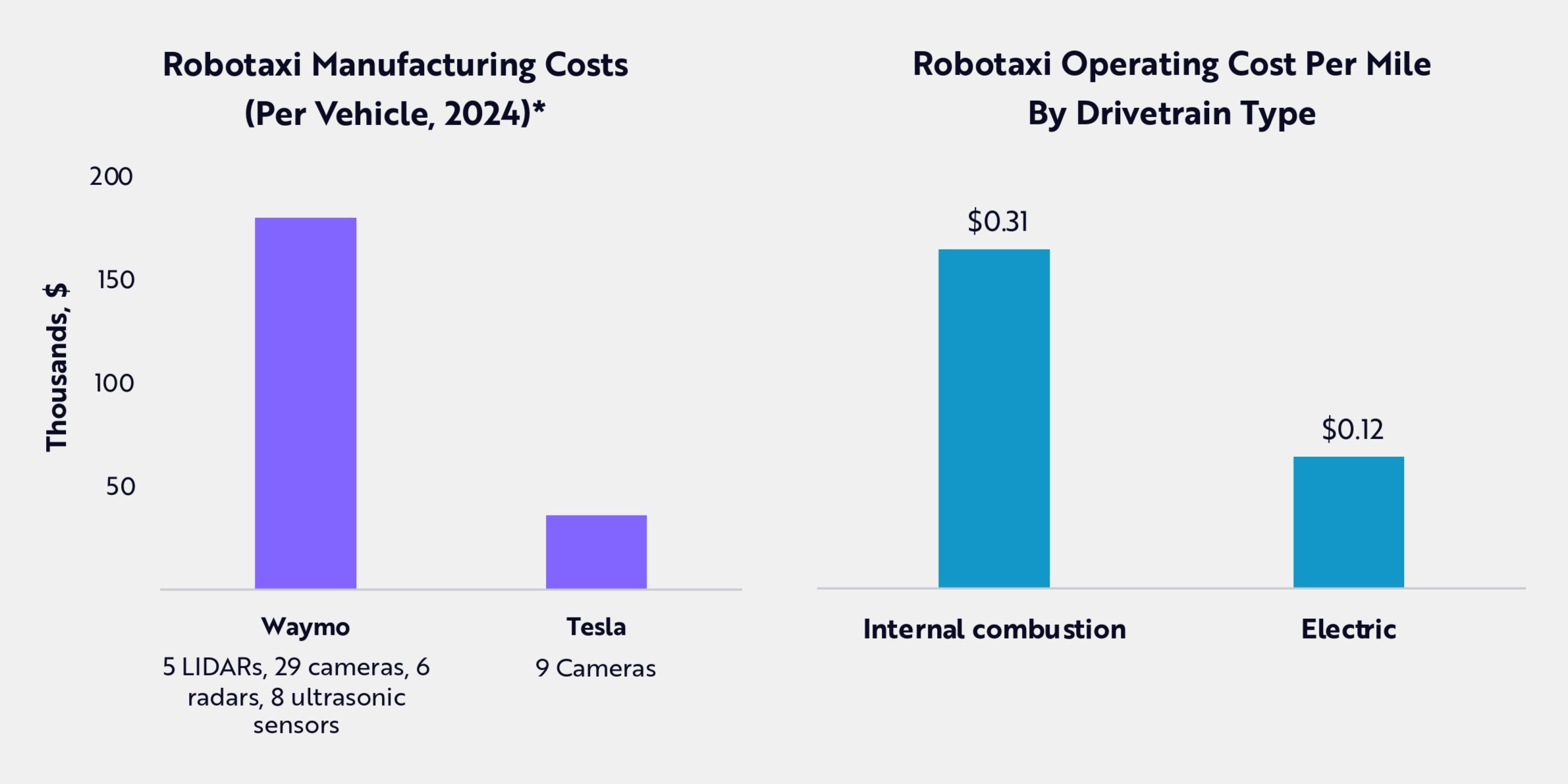

ARK’s research suggests, for example, that advances in AI and Advanced Battery Technology will be profound catalysts for Autonomous Mobility and Adaptive Robotics, improving products and reducing costs. The integration of AI with Autonomous Mobility and Energy Storage Systems is setting the stage for more efficient transportation solutions (as shown in the two charts below), likely to revolutionise business and leisure travel, goods transport, and impact logistics, urban planning, and environmental sustainability.

Sources: ARK Investment Management LLC, 2024. This ARK analysis is based on a range of external sources, which may be provided upon request. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

Assessing the Economic Impact

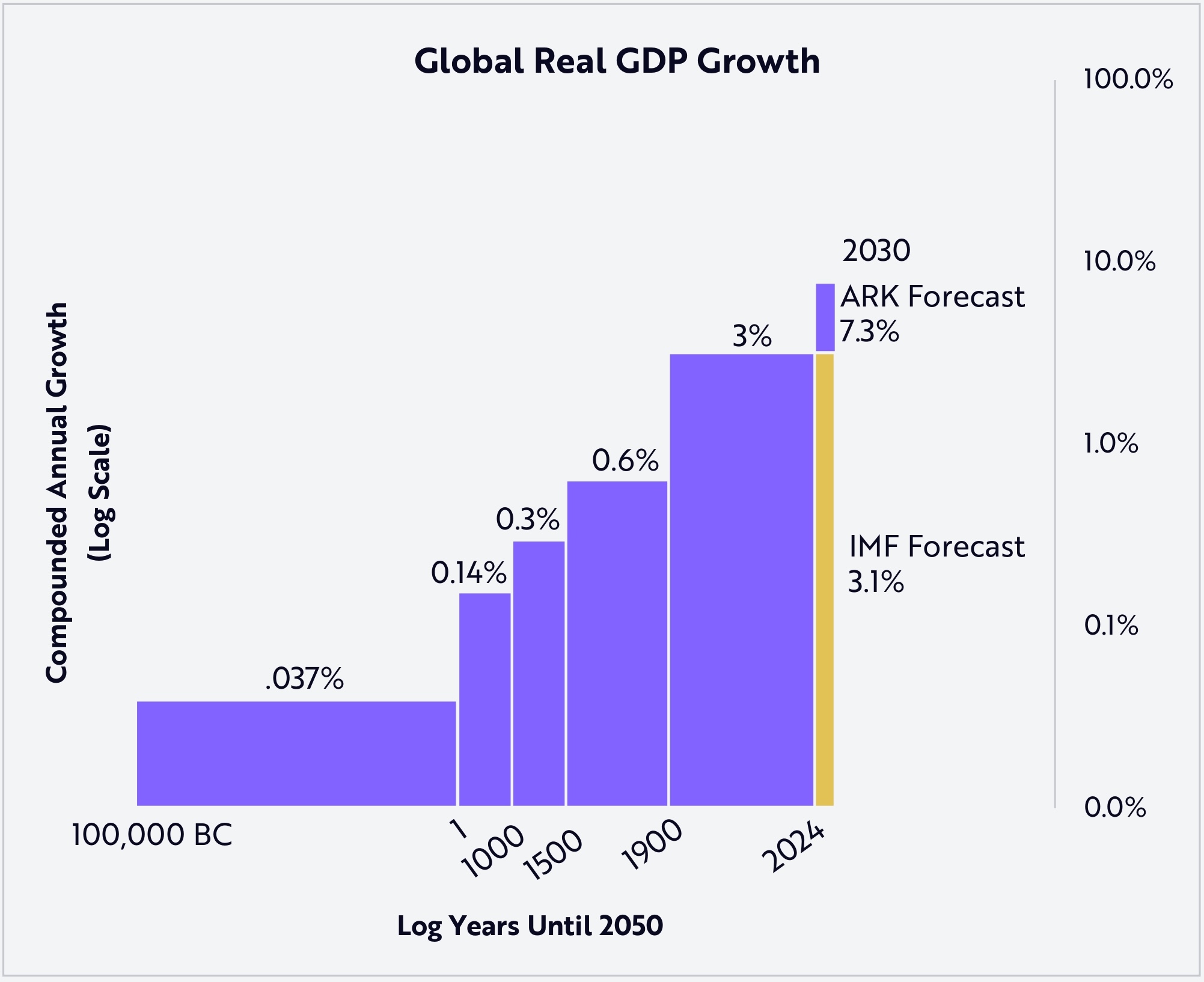

The ripple effects of the convergence between and among the five major innovation platforms also should culminate in a significant acceleration in real economic growth globally. Our research suggests that convergence could create unprecedented global real GDP growth, compounding at 7-8% over the next 5 to 10 years, as shown below.

Global Real GDP Growth [4].

Global Real GDP Growth [4].

This growth is likely to reshape market capitalizations, with disruptive technologies increasingly central to economic development and investment strategies. As shown in our Big Ideas 2025 Report, our research suggests that the total market capitalization of disruptive innovation could command more than two-thirds of the global equity market, compounding at a 38% rate through 2030. The implication is clear: innovation is not merely gaining ground; it is becoming the dominant force in global markets.

// Cathie Wood, CEO/CIO of ARK Invest, and Brett Winton, Chief Futurist of ARK Invest.

Läs mer om fonden Avanza Disruptive Innovation by ARK Invest här.

Tänk på att det kan svänga! Att spara i fonder, aktier och andra värdepapper har över tid varit ett bra sätt att få pengar att växa, men hur det går i framtiden vet ju ingen. Det kan gå både upp och ner så det är alltså inte säkert att du får tillbaka pengarna du satte in från början. Åsikter och slutsatser som framkommer i bloggen är skribentens egna och skall inte ses som investeringsråd och/eller åsikter från Avanza. Fonden förvaltas av Avanza Fonder i samarbete med ARK Invest. För information om hur fonden förvaltas, faktablad & informationsbroschyr se avanza.se/avanzabyark

References

Brynjolfsson, E., & McAfee, A. (2018). ‘The second machine age: Work, progress, and prosperity in a time of brilliant technologies’. Vancouver, B.C.: Langara College

Crafts, N. 2004. ‘Steam as a General Purpose Technology: A Growth Accounting Perspective’. The Economic Journal.

DeLong, B.1998. ‘EsFuntar timating World GDP, One Million B.C. — Present’. Brad De Long’s homepage. Department of Economics, University of California, Berkeley.

Helpman, E. (2010). General Purpose Technologies and Economic Growth. Cambridge, MA: MIT Press

Kurzweil, R. (2016). The Singularity Is Near: When Humans Transcend Biology. Duckworth.

McKinsey Global Institute. 2017. ‘A Future that Works’.

O’Mahoney, M. and Timmer, P. 2009. ‘Output, Input and Productivity Measures at the Industry Level: The Eu Klems Database’. The Economic Journal.

OpenPhilanthropy. 2025.

[1] ARK developed this chart based on the relative impact of an innovation scaled by the degree of consensus between economic historians that a particular innovation should be considered an innovation platform. The underlying data assumes that all innovation platforms follow a characteristic investment and realization cycle of similar duration. The above chart is based on a variety of criteria and assumptions, which might vary substantially, and involve significant elements of subjective judgment and analysis that reflect our own expectations and biases, which might prove invalid or change without notice. It is possible that other foreseeable events that were not taken into account could occur. Source: ARK Investment Management LLC, 2018, based on data from Helpman 2010; Brynjolfsson, and McAfee 2018; Kurzweil 2016. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

[2] Note: “Network density” measures the degree of interconnectedness between nodes relative to the maximum potential interconnectedness. In our research, if every technology were expected to catalyze another technology to increase in value by an order of magnitude or more, that would equate to a fully interconnected network. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.

[3] *Adaptive Robotics, Autonomous Mobility, and AI Impact are ARK Invest estimates. AI estimate includes consumer surpluses that may not be captured in traditional economic statistics. IT productivity impact likely also undercounts consumer surplus. Industrial Robot and IT impact measures impact on US, Europe, and Japanese economies. Steam Engine impact is measured against the UK economy. Sources: ARK Investment Management LLC, 2024, based on data from Crafts 2004, O’Mahony et al. 2009, and McKinsey Global Institute 2017. Forecasts are inherently limited and cannot be relied upon. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results.

[4] Note: Real GDP: Aggregate Global Production adjusted for changes in price levels. Source: ARK Investment Management LLC, 2025. This ARK analysis draws on a range of external data sources including DeLong 1998 and Open Philanthropy as of December 31, 2024, which may be provided upon request. For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security. Past performance is not indicative of future results. Forecasts are inherently limited and cannot be relied upon.