”Disruptive innovation is key to long-term growth”

ARK believes the global economy is undergoing the largest technological changes in history. Our goal is to expose as many investors as possible to this transformation – and we look forward to delivering on this exposure to Swedish investors alongside Avanza. We believe that Avanza’s mission in revolutionizing the fintech space aligns very well with our sole focus since our launch in 2014: Disruptive innovation.

The management strategy of ARK is different

Experienced research team rooted in over 40 years of experience

ARK is rooted in over 40 years of experience in identifying and investing in disruptive innovations that should change the way the world works and deliver outsized growth as industries transform. ARK’s Chief Investment Officer and Chief Futurist have worked together for over 15 years and recognize that disruptive innovation demands a dynamic and universal approach. By researching across sectors, industries and markets, ARK can gain a deeper understanding of the convergence and market potential of disruptive innovations, and thus seize investment opportunities more appropriately.

The 3 biggest technology trends we believe in

Open Research Ecosystem

ARK’s disruptive innovation investment strategy is driven by ARK’s Open Research Ecosystem, which seeks to capitalize on rapid change through an open approach and the convergence of insights. We believe that a combination of top-down and bottom-up research allows us to seize the investment opportunity of disruptive innovation, and then detect and rank companies best positioned to benefit. To gain a deeper understanding of quickly changing themes, we employ an open research strategy to gather information, both helping to define and refine our internal research process. Inputs include theme developers who are thought leaders in their fields, social media interactions, and crowd-sourced insights as people respond to ARK’s public research. By applying technological concepts and external inputs to traditional approaches, ARK seeks to create a more transparent, creative, and interdisciplinary investment process.

Sole focus on disruptive innovation

ARK believes that disruptive innovation is key to long-term growth of company revenues and profits and, therefore, focuses solely on investing in disruptive innovation. We define ‘‘disruptive innovation’’ as the introduction of a technologically enabled new product or service that should change an industry landscape by creating simplicity and accessibility, while driving down costs. Despite its potential, we think the full magnitude of disruptive innovation and the investment opportunities it creates are often unrecognized or misunderstood by traditional investors. ARK performs research across sectors, industries, and markets to gain a deeper understanding of the convergence and market potential of disruptive innovations.

Active management investment process of high conviction portfolios

ARK uses its own scoring system to continuously value companies and monitor the underlying investment thesis. As scores change, ARK’s investment team adjusts stock positions in the portfolio. ARK believes that its consistent investment process and active management of high-conviction portfolios capitalizes on rapid change and avoids industries and companies likely to be displaced by innovation.

ARK aims to identify large-scale investment opportunities by focusing on public companies that are the leaders, enablers, and beneficiaries of disruptive innovation. As such, here are some themes we are observing in five major innovation platform that we believe are enabling the underlying technologies and investment opportunities:

1. Web3 & digital ownership. We predict further mainstream adoption of decentralized standards that enable individuals to own digital assets.

- A country’s adherence to physical and intellectual property rights seems to correlate with its GDP per capita, a common proxy for quality of life. In our view, the same correlation can exist in the realm of digital assets.

- As a generation-defining technology, we believe NFTs will scale to billions of users over the next decade. If spending were to scale in line with users, the market for NFTs could reach trillions of dollars by 2030.

2. Autonomous ride-hail services delight riders across ~15 cities internationally today, including both commercial and non-commercial services. We expect the technology to scale during widespread commercial adoption within the next ten years.

- In 2017, ARK predicted that human-driven ride-hail and autonomous taxis would reduce overall auto sales, resulting in unit volumes ~24 million lower than consensus expectations for 2025. Since then, annual auto sales have declined even more than we predicted, largely because of the supply chain crisis associated with COVID-19. As autonomous taxis begin to dominate urban transit and consumers forgo new car purchases, ARK now expects the delta between our forecast and the consensus forecast to be ~26 million units in 2025 and ~29 million in 2027.

- ARK expects today’s gas-powered automotive manufacturing industry to consolidate in the transition to autonomous electric mobility. Meanwhile, autonomous platform providers – likely a differentiated business mix compared today’s ride-hail companies – should capture most of the future autonomous mobility market value.

3. Precision therapies. ARK believes the convergence of Artificial Intelligence (AI), Next Generation Sequencing (NGS) and Gene Editing has the potential to transform health care. We believe these advances could accelerate the pace of scientific discovery, personalizing medicine to cure disease instead of masking symptoms.

- In the last five years, the number of deaths caused by cancer, cardiovascular and neurological disease has not improved significantly in the developed world. We believe innovations in therapeutics will transform public health radically, causing death and disability rates to decline once again.

What technology trends will not succeed?

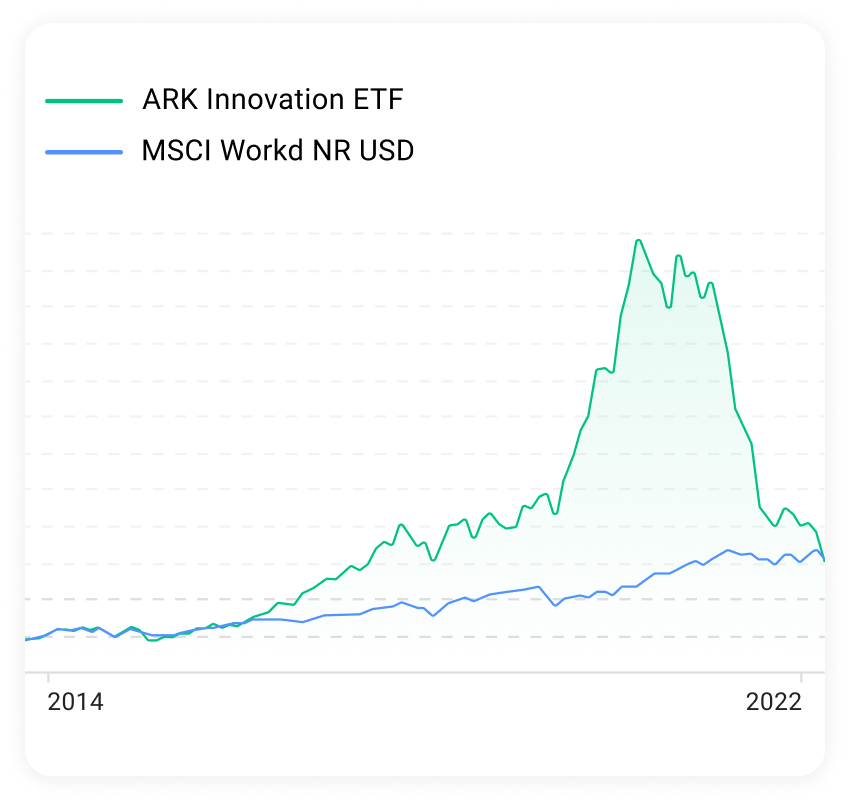

Today, we believe the global economy is undergoing the largest technological transformation in history. Disruptive innovation should displace industry incumbents, increase efficiencies, and gain majority market share. As technologies emerge and transform entire industries, investors in traditional benchmarks may face more risk than historically has been the case.

To help investors stay on the right side of change, our Bad Ideas Report seeks to identify the industries and sectors most at risk of disintermediation and disruption. Based on our research, we believe investors should evaluate and avoid the following ”Bad Ideas”:

- Physical Bank Branches

- Brick and Mortar Retail

- Linear TV

- Freight Rail

- Traditional Transportation

Why invest in this fund?

Avanza Disruptive Innovation by ARK Invest aims to provide long-term growth of capital and seeks to provide broad exposure to disruptive innovation for Swedish investors. ARK believes innovations centered around artificial intelligence, robotics, energy storage, DNA sequencing, and blockchain technology will change the way the world works and deliver outsized growth as industries transform.

The strategy invests primarily in U.S. and foreign equity securities of companies that are relevant to the investment theme of disruptive innovation. Companies within portfolio include those that rely on or benefit from:

- The development of new products or services,

- technological improvements and advancements in scientific research relating to the areas of DNA technologies,

- industrial innovation in energy, automation and manufacturing,

- the increased use of shared technology, infrastructure and services and

- technologies that make financial services more efficient.

We are excited to be partnering with Avanza to make our flagship strategy available to Swedish investors through Avanza Disruptive Innovation by ARK Invest.

// Cathie Wood, CEO and managing director at ARK Invest

Vill du höra mer om visionen och förvaltningsstrategin? Hör Cathie Wood berätta allt du behöver veta i Avanzapodden!

Varför disruptiv innovation? Här berättar Maria allt om nya fonden som fokuserar på banbrytande teknologi som förändrar världen.

Tänk på att det kan svänga! Att spara i fonder, aktier och andra värdepapper har över tid varit ett bra sätt att få pengar att växa, men hur det går i framtiden vet ju ingen. Det kan gå både upp och ner så det är alltså inte säkert att du får tillbaka pengarna du satte in från början. Åsikter och slutsatser som framkommer i bloggen är skribentens egna och skall inte ses som investeringsråd och/eller åsikter från Avanza. Fonden förvaltas av Avanza Fonder i samarbete med ARK Invest. För information om hur fonden förvaltas, faktablad & informationsbroschyr se avanza.se/avanzabyark